Advertiser Disclosure

- Best Certificate Of Deposit Rates Available

- Best Certificate Of Deposits Interest Rate

- Best Certificate Of Deposit Rates

- Best One Year Cd Rates

A variable-rate certificate of deposit may be a good idea if you think interest rates will rise, but you could lose out on growth if they fall. These CDs are ideal for institutional investors because they typically require deposits of $1 million or more, although some may have minimum deposits as low as $100,000. Compare the best CD rates drawn from our research on the approximately 200 banks and credit unions that offer CDs nationwide. Find the best CD rates today! Certificates of deposit can be a. A certificate of deposit (CD) is a type of FDIC-insured deposit account offered by many banks and credit unions that usually has a fixed interest rate over a certain number of months or years.

Editorial Policy Disclosure

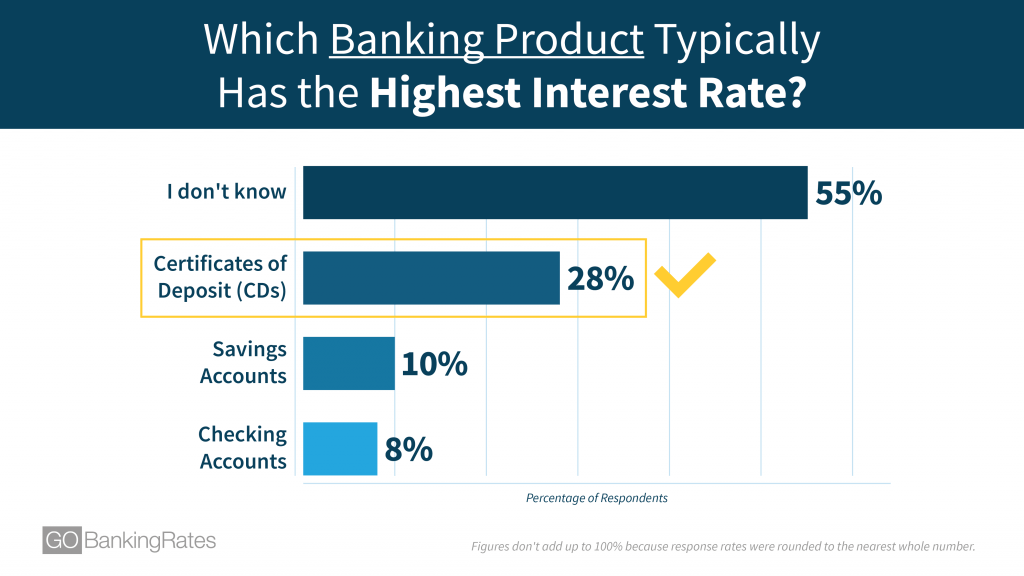

If you’re looking to make the most of your savings, CDs (certificate of deposit accounts) regularly offer interest rates that are higher than the ones offered with traditional savings accounts.

In return for higher CD interest rates, the bank will expect you to deposit your money in an account for an extended period of time, which can span a few months to a few years. One thing to keep in mind about CDs is that you should only invest money that you won’t need for a while. Otherwise, you’ll risk paying a penalty for early withdrawal if you remove your funds from the CD before the term is up.

If you’re sure you can put money away for a longer period of time and you don’t want to pursue riskier investments, CDs might be worth a look. Interest rates vary for CDs across banks, so it’s best to compare the options available before you lock up your money.

Best CD rates of August 2020

- Sallie Mae: Current 1-year CD rate of 0.80% APY

- Marcus by Goldman Sachs: Current 1-year CD rate of 0.85% APY

- Ally: Current 1-year CD rate of 0.75% APY

- Discover: Current 1-year CD rate of 0.80% APY

- Alliant Credit Union: Current 1-year CD rate of 0.75% APY

- Synchrony: Current 1-year CD rate of 0.75% APY

- Capital One: Current 1-year yield of 0.50% APY

- TIAA Bank: Current 1-year CD rate of 0.60% APY

- Charles Schwab: Current 1-year CD rate of 0.15% APY

Ally – Current 1-year CD rate of 0.75% APY

Ally is one of the best online banks in the industry. In fact, Ally guarantees you’ll get the best rate on your CD with the Ally 10-day best rate guarantee. If Ally’s CD rate goes up within 10 days of closing on your CD, it will raise your rate to the higher one. Ally also offers a 0.05% loyalty reward if you renew your current CD. You can renew and choose any CD it offers. Ally also has no minimum balance requirements and it’s convenient to manage your account online.

Capital One – Current 1-year CD rate of 0.30% APY

It’s a common belief that Capital One only offers credit cards, but it has become a top contender in the CD market thanks to its awesome CD rates. With Capital One, there is no minimum deposit for 360 CDs and it’s FDIC insured. The 1-year interest rate for Capital One CD’s is 0.30%, and it increases with the 3-year and 5-year accounts. The highest interest rate you can earn on a CD through Capital One is 0.60%, which is offered on 5-year CDs.

Discover – Current 1-year CD rate of 0.60% APY

Discover may be known for cash-back credit cards, but it recently entered the CD market with competitive rates and top-notch customer service. There’s an app to monitor and access your account, and Discover is one of the only banks to offer CDs with a duration as short as 3 months. It does have an early withdrawal penalty, though, so if your CD term is less than 1 year, the penalty is worth 3 months of simple interest.

TIAA Bank – Current 1-year CD rate 0.60% APY

TIAA Bank offers a wide range of CDs, including its Yield Pledge CDs, which come with higher rates than the bank’s regular CDs. Yield Pledge CD rates are also often higher rates than the competitors, plus you can choose from terms that range from 3 months to 5 years with a $5,000 minimum deposit.

TIAA also offers a Bump Rate CD that starts at an incredibly high rate for a CD and gives you a one-time option to bump your rate during the term of your CD, so if the interest rate increases, you can take advantage of it. The Bump Rate CD is only available with a 3.5-year term, with rates starting at 0.75% APY.

On the downside, TIAA locations are limited. This bank only has brick-and-mortar locations in Florida.

Marcus by Goldman Sachs – Current 1-year CD rate of 0.85% APY

Marcus offers three no-penalty CD options and high yield CDs with nine different terms to choose from. Like TIAA, it offers a 10-day CD rate guarantee and no transaction fees. Marcus doesn’t have a mobile app or physical locations, though, so you’ll have to rely on either the Marcus website, the Goldman Sachs website or customer service for access to your accounts. It does offer CDs with a $500 minimum deposit and very competitive interest rates, though.

Charles Schwab – Current 1-year CD rate of 0.15% APY

Charles Schwab offers brokered CDs, which are sold by a broker rather than a bank. Different banks issue them, so you can choose a competitive rate and term length that’s best for you. It also allows you the opportunity to choose from variable or fixed-rate CDs. Some CDs require high minimum deposits, though, and instead of compounding interest, the interest is paid into your brokerage account at different intervals.

Instead of offering set terms, you can choose from a range of terms instead. For example, a 1-year CD falls into a 10-18 month range, which offers the same 0.15% APY rate for all CDs in that term range.

Synchrony – Current 1-year CD rate 0.60% APY

Synchrony is an online bank that offers great savings opportunities on some of the highest-rate CDs available, and it offers a wide range of term options, too. It doesn’t charge a monthly service fee, but it does require a rather high $2,000 minimum deposit, even on basic CDs. The minimum deposit may pose a hardship for some, but with that higher deposit comes the opportunity to earn more interest.

With Synchrony, you can choose from terms as short as three months and as long as 60 months. Synchrony doesn’t have physical bank locations, but you can manage your CD through 24/7 digital banking.

Alliant Credit Union – Current 1-year CD rate 0.55% APY

Alliant Credit Union serves people who work for, or previously worked for, certain employers, including United Airlines. It also serves family members of existing Alliant members, along with people who live or work in certain communities in Illinois, members of select organizations, or anyone who makes a $5 donation to the nonprofit group Foster Care to Success. Alliant currently has more than 390,000 members across the U.S., as well as competitive CD rates. There’s a minimum deposit of $1,000, though, and an early withdrawal penalties. The best way to apply is online.

Compare Best CD Rates of September 2020

Rates as of 9/21/2020

National average CD rates

Rates data as of 9/18/2020 from the FDIC

What is a CD?

As we touched on above, a certificate of deposit, also known as a “share certificate” at credit unions, is a way to earn a high interest rate on your savings by leaving your money in the bank for a specific amount of time. In general, a CD is less liquid because you can’t access the money during the term you agreed to without penalty, so you earn a higher interest rate in return. CD terms can be as short as 3 months or as long as 5 years, or sometimes longer, and the general rule is that the longer the term you agree to, the better the interest rate.

CDs are a safer investment than other high yield investments, like money market accounts or the stock market, because the FDIC insures deposits at member banks and credit unions up to the maximum amount allowed by law. You won’t lose your money as the market fluctuates, nor will your interest rate decrease (unless you agreed to a variable interest rate), so you’ll have the peace of mind with a CD that your money is safely tucked away.

Best Certificate Of Deposit Rates Available

Because CD interest rates are higher than traditional savings accounts, they can be a great way to maximize the return on your money in more ways than one. As a rule, putting your money into a CD will boost both your interest rate and your annual percentage yield, which is the return that comes from compounding the interest over the course of the term.

Most banks and credit unions typically require you to hold a minimum balance in your savings account or face monthly charges, and these charges can offset any interest you may have earned. That’s quite different than the life of a CD. As long as you keep your money in your CD for the length of the term, you will likely not incur any monthly charges.

CDs vs money market accounts

In general, CDs offer the highest interest rates. However, they also require you to set aside your money for a predetermined period of time. Make an early withdrawal, and you may get hit with a penalty. Money Market accounts offer you more flexibility to withdraw money on short notice, similar to the flexibility provided by a savings account.

With a money market account, you earn variable interest, but with a CD, you earn comparatively higher interest rates. Like savings accounts, money market accounts allow you to make up to six monthly withdrawals. Withdrawals during a CDs term will often result in a penalty.

CDs vs savings accounts

If your money is in a savings account, it’s available when you need it. Savings accounts are a useful way to stow money away for unexpected emergencies or large purchases. CDs, on the other hand, often charge a penalty if you want to withdraw your money before the agreed upon term is up. Your interest rate is most often higher and fixed for the length of the term, though, while interest rates on a savings account can, and do, fluctuate and are lower than CDs.

Traditional CDs vs IRA CDs

CDs and IRA CDs look similar on the surface, but if you dig a little deeper you’ll find subtle differences. An IRA CD is a CD that you buy with the funds you have in your retirement account and there are tax breaks on this type of CD. If you were to invest all the retirement funds in your IRA in a CD, then the IRA would become an IRA CD.

You can deposit as much as you like into a regular CD, provided that you’re following the terms of the CD and the bank. With an IRA CD, you are restricted as to how much you can invest. Both types of CDs may have early withdrawal penalties, but with an IRA CD, an early withdrawal will trigger taxes and penalties related to your retirement account. You can earn higher interest rates with an IRA CD, but the terms are usually longer than with CDs.

The impact of 0.10% on $1,000

Depending on what you’re looking for, you may end up considering several types of CDs, including IRA CDs held in a tax-advantaged account, jumbo CDs, which have a high minimum-balance requirement,or a liquid CD that allows you to take funds out without incurring a penalty. No matter which you choose, though, it’s important to understand the importance of APY on your CD. Let’s look at how a 0.1% change in the rate on your CD would impact the outcome over the term of the product. Assume your bank calculates and pays interest only once at the end of the year.

Calculating a 0.1% change on a $1,000 CD

| Term | Deposit | Earned APY 2.40% | Add 0.1% Change |

| 6 months | $1,000 | $11.93 | $12.42 |

| 12 months | $1,000 | $24.00 | $25.00 |

| 18 months | $1,000 | $36.22 | $37.73 |

| 60 months | $1,000 | $125.90 | $131.41 |

As you can see, the 0.1% adds up, especially over time. A 6-month CD with a $1,000 deposit can increase from $11.93 in interest to $12.42 in interest by the end of the term, and interest on a 60-month CD would increase from $125.90 to $131.41. Adding a 0.1% change may not seem like much, but with higher amounts and longer periods of time, it can really add up. Use this information to help you to decide if you want to lock your money away in a CD, which bank is right for you, how much you want to invest.

When I was younger, I never understood the appeal of certificates of deposit. You put your money in a lockbox, you get a tiny little interest rate, and then after a year or two or five, you get a little bit more than you put in.

As I’ve gotten older, I’ve realized that there’s value in principal protected, interest-bearing accounts. High yield savings accounts are the best and CDs are a close second if you don’t need the cash for a minute. CDs are great because it’s principal protected, FDIC insured, and completely safe.

Once I did a little more digging, there’s more to a Certificate of Deposit than its interest rate.

How to Find a Good CD

The math behind Certificates of Deposit is simple to understand.

The longer the CD, the higher the interest rate.

Brick and mortar banks just aren’t able to offer the same interest rates as online banks.

So go with as long of a CD as you can with an online bank. Boom, done.

Here’s a typical schedule from an online bank, as of January 2021:

As you can see, the longer the term, the greater the interest rate.

Here’s a similar schedule from a brick and mortar bank, as of January 2021:

Best Certificate Of Deposits Interest Rate

Brick and mortar banks often can’t hold a candle to online banks.

Minimum Deposits & Interest Rate Tiers

Online banks almost always a minimum deposit of $1 and the interest rate applies to small CDs as well as larger ones. Some online banks will have tiers but the lowest ones are typically very good anyway.

Brick and mortar banks will change the interest rate based on how much you deposit. The tiers are often in the thousands of dollars to get better interest rates.

For example, here are the interest rate tiers for a 60-month CD (Feb 2018):

- $0 – $9,999.99 – 0.60% APY

- $10K – $24,999.99 – 0.80% APY

- $25K – $49,999.99 – 0.80% APY

- $50K – $99,999.99 – 0.80% APY

- $100K – $249,999.99 – 0.85% APY

- $250K+ – 0.85% APY

Capital One 360 has a 60-Month CD with a 2.65% APY, no minimums to get that highest tier.

A 36-month CD at Ally Bank is an example of an online bank with tiers (March 2018):

- $0 – $4,999.99 – 2.6% APY

- $5K – $24,999.99 – 2.70% APY

- $25K – $49,999.99 – 2.75% APY

Early Withdrawal Penalty

There is one feature that often differs between banks, other than interest rates – the early withdrawal penalty.

You’d think that there wouldn’t be many variations among banks on the early withdrawal penalty – but there is.

:max_bytes(150000):strip_icc()/roundup_primary_INV_personalloans2-69d3c2db89d744a7b54abc5c75771e1e.jpg)

The early withdrawal penalty is assessed if you close your CD before its maturity date. You always have the option to withdraw your funds and close the entire CD, you simply surrender some or all of your accrued interest.

The penalty varies based on the length of the CD.

Ally Bank has the lowest early withdrawal penalties:

- 24 months or less: 60 days of interest

- 25 months – 36 months: 90 days of interest

- 37 months – 48 months: 120 days of interest

- 49 months or longer: 150 days of interest

Discover Bank has a more typical early withdrawal penalty schedule at online banks:

- 11 months or less: 3 months of interest

- 1 year to < 4 years: 6 months of interest

- 4 years to < 5 years: 9 months of interest

- 5 years to < 7 years: 18 months of interest

- 7 to 10 years: 24 months of interest

Here’s a brick and mortar schedule, from Bank of America:

- 90 days or less: greater of all interest earned or 7 days of interest

- 90 days up to 12 months: 90 days of interest

- 12 months – 60 months: 180 days of interest

- 60 months or longer: 365 days of interest

Different CD Types

Up until now, you’ve seen the most basic CD – you deposit a sum, it accrues interest until maturity, then you get it all back.

There are banks with CDs that have extra features.

Ally Bank has led the way with the variety of CDs they offer:

- High Yield CD – This is their name for the standard CD.

- Select CD – This CD changes from time to time but will be an oddball term with a promotional rate. At the moment, it is a 2.15% APY 30-Month Select CD that automatically renews into an 18-Month High Yield CD when it matures. Ally doesn’t otherwise offer a 30-Month maturity.

- Raise Your Rate CD – If you dislike CD rates going up when you’re locked in, this 24-month or 48-month CD has a competitive interest rate that can bump up (once for a 2-year, twice for a 4-year) if the rate increases.

- No Penalty CD – This CD has no early withdrawal penalty, but it’s usually an odd maturity (now 11 months) and a slightly lower interest rate.

Renewal Bonus

If it feels like Ally Bank gets a lot of love in this post, it’s because I use them and they have some of the most innovative deposit products in the CD space.

One of those innovations is what’s known as a “Loyalty Reward.”

Best Certificate Of Deposit Rates

If you renew a CD at Ally Bank, they give your interest rate a little bump. As of February 2018, that bump is only 0.05% APY:

Hi Jim, we currently offer a .05% Loyalty Reward for CD renewal, and will keep the community updated on any future offerings as they become available. Please let us know if we can answer any further questions! ^KM

Best One Year Cd Rates

— Ally (@Ally) February 22, 2018

When you renew, you take whatever the prevailing interest rate and add 0.05% APY. In previous years, when interest rates were higher, I saw Loyalty Rewards as high as 0.50% APY.

You now have a solid understanding of the lay of the land when it comes to certificates of deposit!